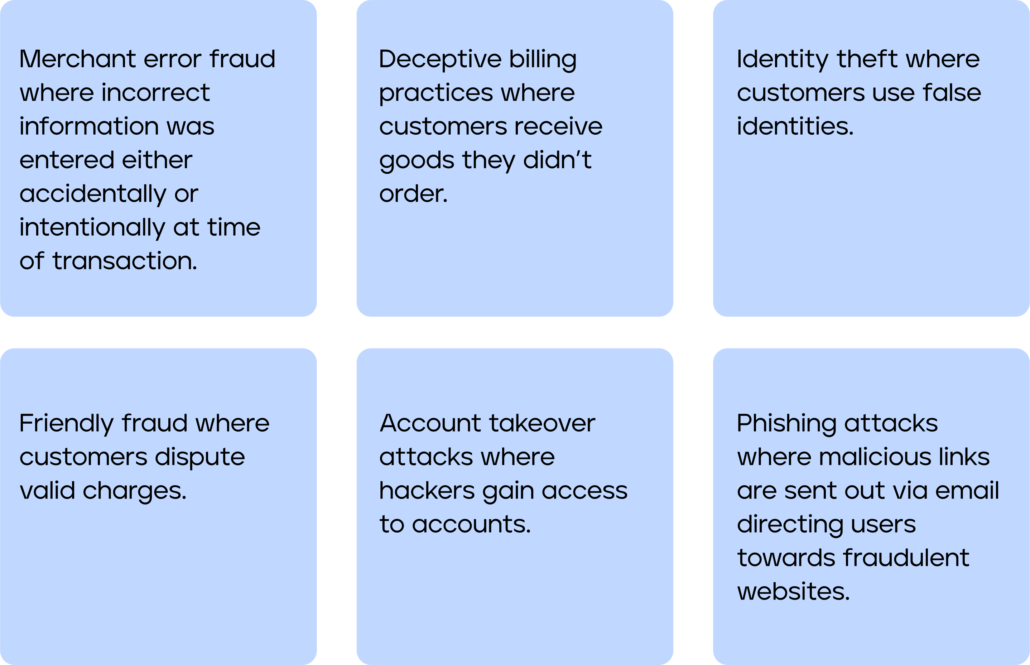

MOTO Payments: The Essential Guide for Fraud and Risk Teams

MOTO payments, or ‘Mail Order / Telephone Order’ payments, are a type of electronic payment that have been used for decades. They differ from ecommerce transactions in that the merchant is processing cardholder data manually and not through an online store. This means that MOTO payments are often more vulnerable to fraud than eCommerce transactions, but with the right security protocols in place, they can be just as safe. Here we discuss the importance of MOTO payments in the 3D Secure space, examine common types of fraud associated with these payments, provide ways to prevent fraud and explain how 3D Secure authentication helps protect both merchants and customers.

What is MOTO?

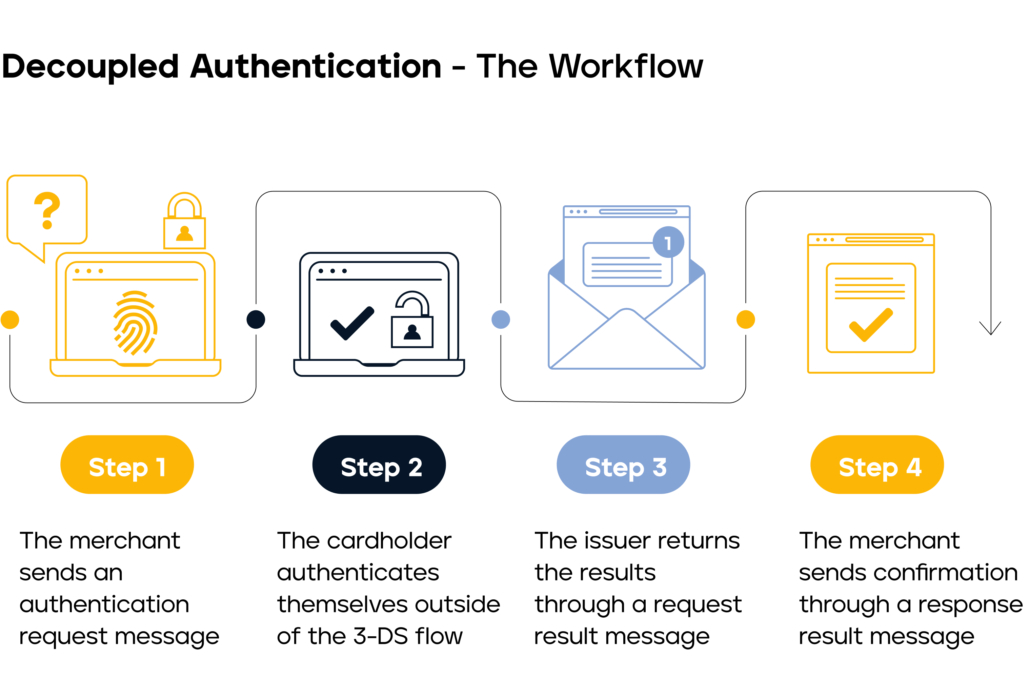

MOTO payments involve the manual entry of cardholder data by a merchant or third-party processor. This includes all relevant information such as the card number, expiration date, and security code. Merchants using MOTO must abide by PCI-DSS regulations to ensure secure handling of customer data. In addition to manual entry via telephone or mail order forms, MOTO can also include decoupled authorisation (or offline authorisation), which allows merchants to securely process payments without taking possession of a customer’s card details.

How do MOTO transactions differ from eCommerce Transactions?

The main difference between MOTO transactions and ecommerce transactions is the way in which cardholder data is collected and processed. With ecommerce transactions, customers enter their payment details directly into a secure online form or gateway provided by the merchant or third-party processor whereas with MOTO transactions these details are handed over verbally via telephone calls or through mail order forms sent out by merchants.

Additionally, while both types of payment require some degree of risk assessment and authentication prior to completion (e.g., 3D Secure), only with MOTO do merchants have access to more direct methods such as signature verification or identity checks when verifying certain customers’ identities prior to completing their transaction.

What is the importance of MOTO in the 3D Secure space?

MOTO plays an important role in the 3D Secure space by providing an additional layer of authentication for Card Not Present (CNP) transactions —and providing liability-shifting capabilities for CNP transactions during 3D Secure authorisation windows when chargebacks may still occur despite a successful authentication.

This means that if a customer were to dispute a valid CNP transaction after it had been successfully authenticated through 3D Secure or if any fraudulent activity occurred within a CNP transaction during its authorisation window, then merchants would be protected from financial loss due to chargebacks through liability-shifting initiatives provided by 3D Secure authentication.

How does 3D Secure Help Prevent Fraud in MOTO Transactions/Environments?

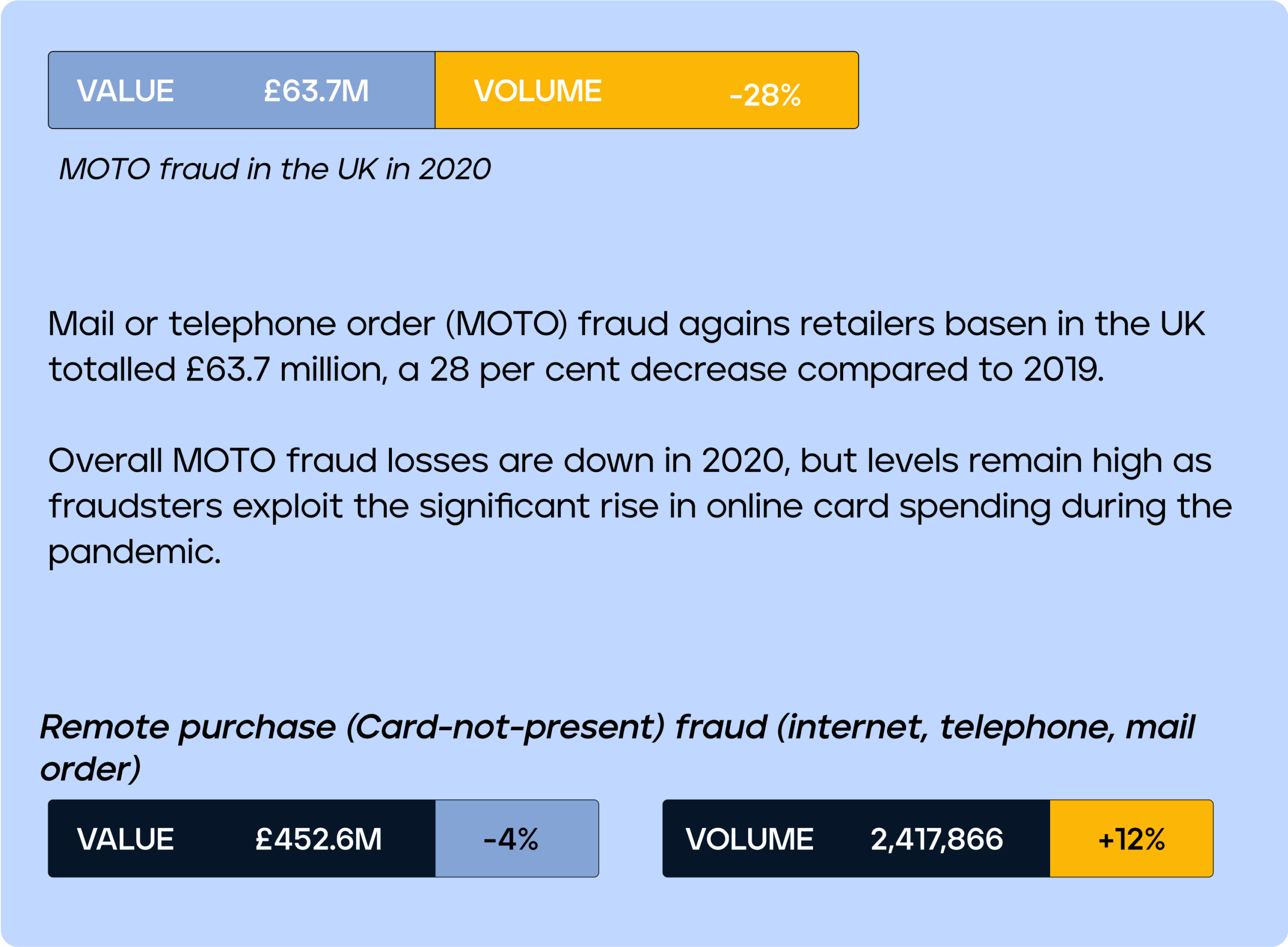

The most common type of fraud associated with MOTO payments are fraudulent orders placed using stolen credit cards;. However, there are other types including:

It is, therefore, essential for businesses accepting MOTO payments to have strong fraud prevention measures in place including risk-based authentication (RBA) protocols, which assess each individual transaction against various parameters such as IP address location anomalies before approving it for completion — otherwise they run the risk of being exposed to potential fraud.

How to Prevent Fraud in MOTO Payments?

There are a number of ways businesses can reduce their exposure to potential fraud when accepting MOTO Payments, which are as follows:

- Use risk-based authentication (RBA) protocols – assess the level of risk associated with a specific transaction or customer and determine the appropriate level of authentication required to complete the transaction securely.

- Educate employees on security protocols – ensure employees observe security protocols when collecting customer payment information over phone calls or mail order forms such as verifying credit/debit cards via 3D Secure before completing any purchase orders.

- Implement strong customer authentication (SCA) – a two-factor authentication process that requires customers to provide at least two of the following three factors:

- Knowledge: Something only the customer knows, such as a password, PIN, or answer to a security question.

- Possession: Something only the customer has, such as a mobile phone, token, or smart card.

- Inherence: Something unique to the customer, such as a fingerprint, facial recognition, or iris scan.

- Utilise monitoring systems – track customer behaviour patterns over time to easily detect any suspicious activity occurring during MOTO Payment processing sessions.

- Levarage advanced analytics tools – uncover hidden patterns behind large datasets and identify potential risks associated with certain customer profiles.

The Future for MOTO Payments

MOTO payments continue to grow in line with the growth trajectory of ecommerce across global markets— they have become increasingly popular with small businesses that do not necessarily have the resources required to set up online stores but still need a secure way of accepting electronic payments.

As new technologies, such as machine learning and AI, emerge and mobile wallet applications gain popularity among consumers, we anticipate that the sector will present more significant opportunities for businesses to securely process MOTO payment requests. This can effectively reduce the exposure associated with fraud and risk, ultimately making MOTO payments safer than ever before.

How to Process MOTO payments as a Retailer

To sum up, we have gained knowledge about the distinctive features of MOTO transactions in comparison to ecommerce transactions, as well as examined different kinds of fraud commonly associated with MOTO environments. Furthermore, we have analysed the approaches that businesses can utilise to minimise probable risks associated with MOTO payments, including utilising comprehensive fraud and risk management solutions such as GPayments’ 3DS Server, ActiveServer, available for on premise or on the cloud. By employing such services, merchants and cardholders can be shielded from financial losses due to chargeback disputes and fraud, ensuring safety for all parties involved.

If you want to learn more about GPayments’ solutions designed specifically to help prevent fraud, please contact us and one of our friendly team members will be in touch with you shortly.