3D Secure 2 is an upgraded version of the global standard for card authentication. It is designed to address several pain points of 3D-Secure 1 and offers numerous benefits, especially from a mobile payments standpoint and is the only fraud prevention solution to comply with Strong Customer Authentication framework (SCA) out of the box.

Working Mechanism

3D Secure 2 analyses over 100 key data points, including the merchant’s contextual data, acting as an advanced layer of fraud protection. The cardholder enters their card details at checkout. At this point, the merchant’s 3D Secure service provider sends an authentication request with rich data to the issuer. Behind the scenes, 3D Secure 2 combines data from the merchant, issuing bank, and card scheme to determine the risk of each transaction. Depending on the risk score, transactions can be approved, challenged, or declined. The ‘three domain (3D)’ refers to the following three parties involved in processing a secure payment:

- The issuer domain (the bank which issued the card) where transactions are authorised

- The acquirer domain (the merchant and the bank that gets the money) where 3D Secure transactions begin

- The interoperability domain (the service provided by the credit card company — Visa, Mastercard, etc.) that provides the infrastructure to securely switch transactions between issuers and acquirers

Benefits

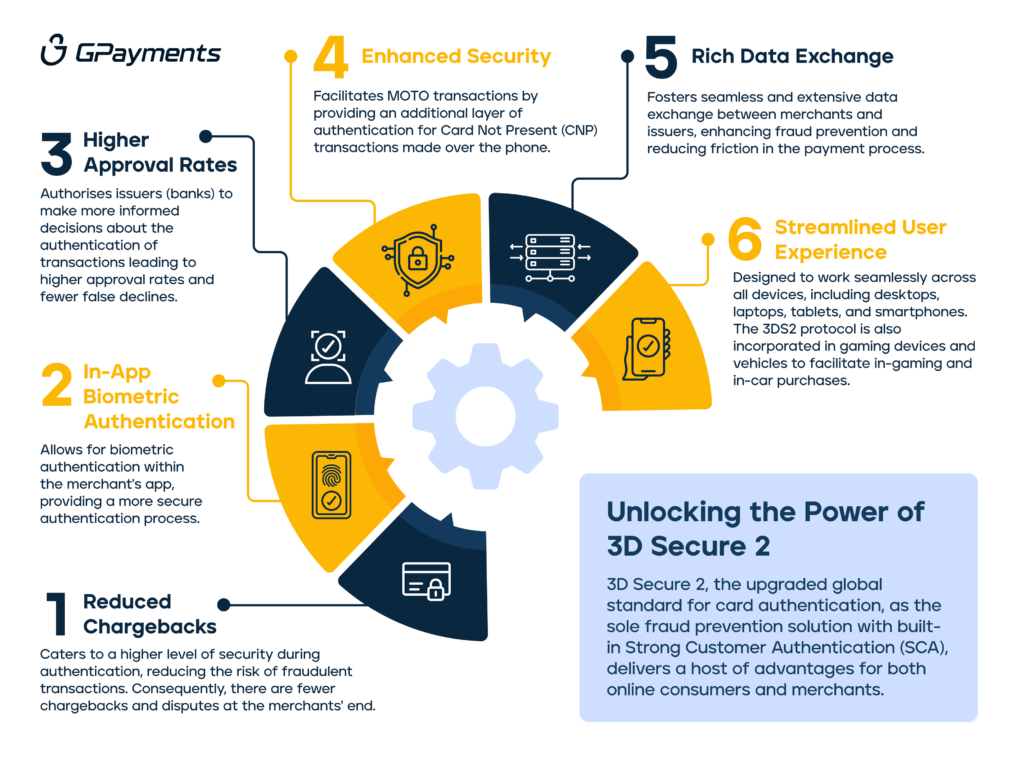

- Reduced Chargebacks: 3D Secure 2 provides a more secure and robust authentication process that reduces the risk of fraudulent transactions. This, in turn, reduces the number of chargebacks and disputes at the merchants’ end.

- Increased Conversion Rates: 3D Secure 2 offers a more seamless and user-friendly authentication process that reduces the friction associated with online payments. This leads to higher conversion rates and fewer abandoned transactions.

- Higher Approval Rates: Allowing for more data exchange between the merchant and the issuer, 3DS2 enables issuers to make more informed decisions about whether to approve or decline a transaction. This results in higher approval rates and fewer false declines.

- Streamlined User Experience: The 3D Secure 2 protocol is designed to work seamlessly across all devices, including desktops, laptops, tablets, and smartphones. This ensures a consistent user experience regardless of the device in use.

- Rich Data Exchange: 3D Secure 2 enables the exchange of more data between the merchant and the issuer, which helps prevent fraud and reduce friction in the payment process.

- Cross-Platform Compatibility: 3D Secure 2 is fully compatible with mobile wallet applications and in-app transactions, making it easier for users to make payments using their mobile devices.

- In-App Biometric Authentication: It allows for biometric authentication within the merchant’s app, which provides a more seamless and secure authentication process.

- Frictionless Flow: 3D Secure 2 allows for risk-based authentication in the access control server (ACS), which enables issuers to approve a transaction without input from the cardholder. This eliminates the need for pop-up windows and static passwords, making the checkout process more frictionless.

- Non-Payment Authentication: 3D Secure 2 can be used for non-payment authentication, such as adding credit cards to e-wallets.

- Native Mobile Integration: With the addition of an SDK component, 3D Secure 2 can now be natively integrated into mobile apps, providing a more consistent user experience, and reducing friction in the payment process.

- High-Assurance MFA for Tokenisation: To initiate tokenisation, the issuer must be able to challenge the cardholder or authenticate them before tokenisation can be done. 3D Secure 2 can be utilised for Multi-Factor Authentication (MFA) to be eligible to participate in Token Authentication frameworks/programs and for fraud liability protection.

- Enhanced Security: In MOTO transactions, 3D Secure 2 plays an important role by providing an additional layer of authentication for Card Not Present (CNP) transactions and providing liability-shifting capabilities for CNP transactions during 3D Secure authorisation windows when chargebacks may still occur despite a successful authentication.

Conclusion

3D Secure 2 not only helps in streamlining online payments but also helps minimise cart abandonment due to denials, which leads to more revenue for merchants. Since the online transactions are verified and there is an extensive data exchange between the card issuers and merchants, there are fewer chargebacks and labour losses due to fraud. It also contributes to reduced liability because if a fraudulent transaction is verified through 3D Secure, the liability shifts to the acquiring bank instead of the retailer.